Increased Focus on Cash Flow Management

The Accounts Receivable (AR) Automation Software Market is experiencing a heightened focus on cash flow management as businesses strive to maintain liquidity in a competitive environment. Effective cash flow management is essential for sustaining operations and funding growth initiatives. AR automation software provides tools that enable organizations to monitor receivables in real-time, facilitating timely follow-ups and reducing days sales outstanding (DSO). Recent studies indicate that companies utilizing AR automation can improve their cash flow by as much as 30%. This focus on cash flow optimization is likely to drive further investment in AR automation solutions, as businesses seek to enhance their financial stability.

Regulatory Compliance and Risk Management

In the Accounts Receivable (AR) Automation Software Market, the emphasis on regulatory compliance and risk management is becoming increasingly critical. Organizations are required to adhere to various financial regulations, which can be complex and time-consuming. AR automation software assists in maintaining compliance by automating reporting and documentation processes, thereby reducing the risk of non-compliance penalties. Furthermore, the software can provide real-time insights into financial health, enabling businesses to identify potential risks early. This proactive approach to risk management is likely to bolster the demand for AR automation solutions, as companies seek to mitigate financial risks while ensuring compliance with evolving regulations.

Expansion of E-Commerce and Digital Transactions

The rapid expansion of e-commerce and digital transactions is significantly influencing the Accounts Receivable (AR) Automation Software Market. As more businesses transition to online platforms, the volume of transactions increases, necessitating efficient accounts receivable processes. AR automation software is essential for managing these high transaction volumes, ensuring timely invoicing and payment collection. The shift towards digital payments also requires robust systems that can integrate seamlessly with various payment gateways. This trend is expected to continue, with projections indicating that e-commerce sales will reach unprecedented levels in the coming years. Consequently, the demand for AR automation solutions is likely to surge as businesses adapt to this evolving landscape.

Rise of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies into the Accounts Receivable (AR) Automation Software Market is transforming how businesses manage their receivables. AI-driven analytics can predict payment behaviors, allowing organizations to tailor their collection strategies effectively. This technological advancement not only enhances the accuracy of forecasting but also improves customer interactions by personalizing communication. As AI and ML continue to evolve, their application in AR automation is expected to grow, potentially increasing market value significantly. Companies that leverage these technologies may gain a competitive edge, further propelling the adoption of AR automation solutions.

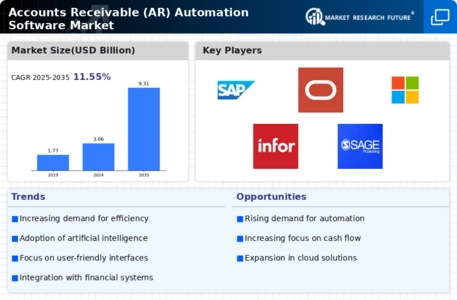

Growing Demand for Efficiency in Financial Operations

The Accounts Receivable (AR) Automation Software Market is witnessing a pronounced demand for enhanced efficiency in financial operations. Organizations are increasingly recognizing the need to streamline their accounts receivable processes to reduce operational costs and improve cash flow. According to recent data, companies that implement AR automation can experience a reduction in processing time by up to 70%. This efficiency not only accelerates cash collection but also minimizes human error, which can lead to costly discrepancies. As businesses strive to optimize their financial operations, the adoption of AR automation software becomes a strategic imperative, driving growth in the market.